What if your paycheck could talk? What if it whispered a secret? Not just any secret, but one that could save you a bundle come tax season. What if you could peek into the future, not to see your...

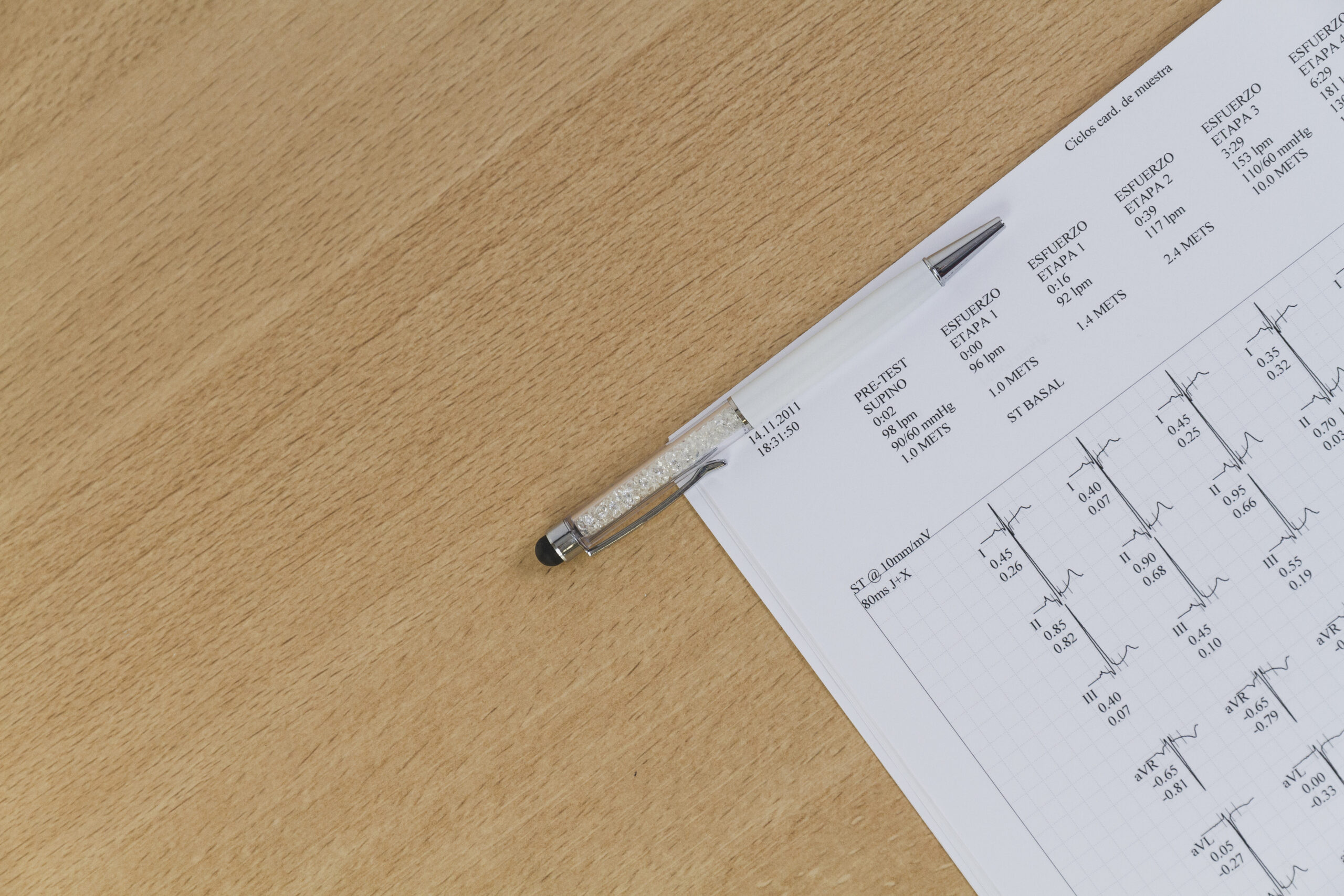

The IRS loves acronyms, and figuring out all those forms can be confusing. Here are a few key players: The Building Blocks Income: Income is the money you earn. Simple, right? Well, not so fast. Income can wear various...

If it sounds too good to be true, it probably is. We’ve all heard this saying, and when it comes to taxes, it couldn’t be more accurate. History teaches us that the tax season can be a bit like...

It’s a common question we get as financial professionals: what happens to taxes when a couple decides to part ways? What Is Your Filing Status Now? Divorce and separation are emotionally charged events, and the last thing on many...

Cooper and Ann just got married! However, amidst the bliss, there’s one thing they might not have thought about yet – the tax side of marriage. Now, taxes may not be as romantic as candlelit dinners, but they are...

If you’re reading this, you’re probably in one of three boats: No matter which boat you’re in, one thing’s for sure: taxes can be confusing. The jargon, the forms, the deadlines – it’s enough to make anyone’s head spin....

It’s natural to want to set ourselves up for financial success, and one key aspect of this is understanding and implementing tax-efficient saving strategies. By the end of this read, you’ll have a clear understanding of actionable steps to...

“Taxes? In January?” January may seem like an unlikely time to think about taxes, especially when you’re still recovering from holiday hangovers and adjusting to the routine of the new year so much so that the mere thought of...

If as a 2024’er, you still think taxes are like an avalanche of paperwork only Einstein could solve, it’s time to rethink that perspective. I mean, you’re probably ordering groceries online, and streaming your favorite shows on demand. So...

Staying current on tax laws and changes is crucial for individuals and businesses alike. The tax code is constantly evolving, and failure to keep up with these changes can result in costly mistakes, missed opportunities, and even legal consequences....